HDX Token

Purpose

The HDX token is a governance token that allows staked token holders to decide the future of the protocol. Our mission with the Hydration DAO is to distribute all decision-making to create a trustless liquidity protocol built around community-growth and self-sustainability.

To have a vote in the Hydration DAO, and to contribute to the determination of any of the topics raised by community members, one must hold the HDX governance token. For more specifically on the governance process, please read our Democracy documentation.

HDX serves multiple functions within the Hydration ecosystem:

- Governance participation: Voting on protocol upgrades, parameter adjustments, and community proposals

- Value accrual: Receiving protocol revenue through staking rewards and buyback distributions

- Ecosystem alignment: Incentivizing behaviors that benefit the protocol's long-term sustainability

- Treasury management: Directing the allocation and deployment of Protocol-Owned Liquidity (POL)

Why Hold HDX Tokens?

Hydration takes sustainability very seriously, placing it at the heart of all decision making. For this reason, the HDX token is non-inflationary, with a design that ensures long-term value accrual to token holders through multiple mechanisms:

Protocol-Owned Liquidity (POL)

Hydration accumulates POL such that the protocol owns liquidity and supplies said liquidity to the various markets. This provides the protocol with a liquidity of last resort that users can rely on, ensuring trading depth even during market volatility. The upshot to having POL is that the protocol can earn fees on its liquidity, which accrues value back to HDX holders through various means:

- Revenue from trading fees generated by protocol-owned liquidity

- Interest earned on deployed assets

- Strategic positioning in high-yield opportunities across the ecosystem

HDX Buybacks

On Hydration, there are two kinds of buybacks: automatic and governance-directed.

Hydration automatically uses 50% of asset fees from every trade to buyback HDX tokens. Thanks to owning its own block production, the Hydration protocol can execute these buybacks whenever there is space in the block, making them resistant to MEV and ensuring the best execution for HDX holders. This creates a constant, organic demand for HDX that scales with protocol usage. You can view how these buybacks are distributed here.

Using Protocol Owned Liquidity (POL), HDX holders can vote to buyback HDX and redistribute to holders, use as incentives for liquidity campaigns, or store in the treasury. In 2025, over 197 million HDX acquired via buybacks using DAI (obtained from the LBP) throughout 2024 will be distributed to HDX stakers. Together, these buyback mechanisms create a virtuous cycle where:

- Protocol revenue continuously reduces circulating supply through automatic buybacks

- Additional governance-directed buybacks provide targeted value distribution

- Value is returned directly to stakers and governance participants

- Long-term holders are rewarded for their commitment to the protocol

Non-Inflationary Staking

HDX stakers receive rewards that are not subject to any inflation. These rewards are powered by a combination of POL, HDX buybacks, and other profit-making strategies. Unlike many DeFi protocols that dilute token holders through constant inflation, Hydration's reward mechanism ensures that stakers receive value from actual protocol revenue rather than from newly minted tokens.

How The Protocol Makes Money (Revenue Streams to HDX Holders)

Hydration has designed multiple revenue streams that ultimately benefit HDX holders:

- LP Fees: By providing liquidity using its POL and earning rewards on deployed assets

- Trading Fees: A portion of all trading activity on Hydration flows back to the protocol

- Borrowing Fees: Interest paid by users of Hydration's lending services

- Liquidation Penalties: Fees collected when undercollateralized positions are liquidated

- Stablecoin Fees: Minting and stability fees from HOLLAR (when launched)

These revenue streams create a sustainable economic model where protocol usage directly translates to value for HDX holders through governance-directed distribution of profits.

HDX Token Allocation

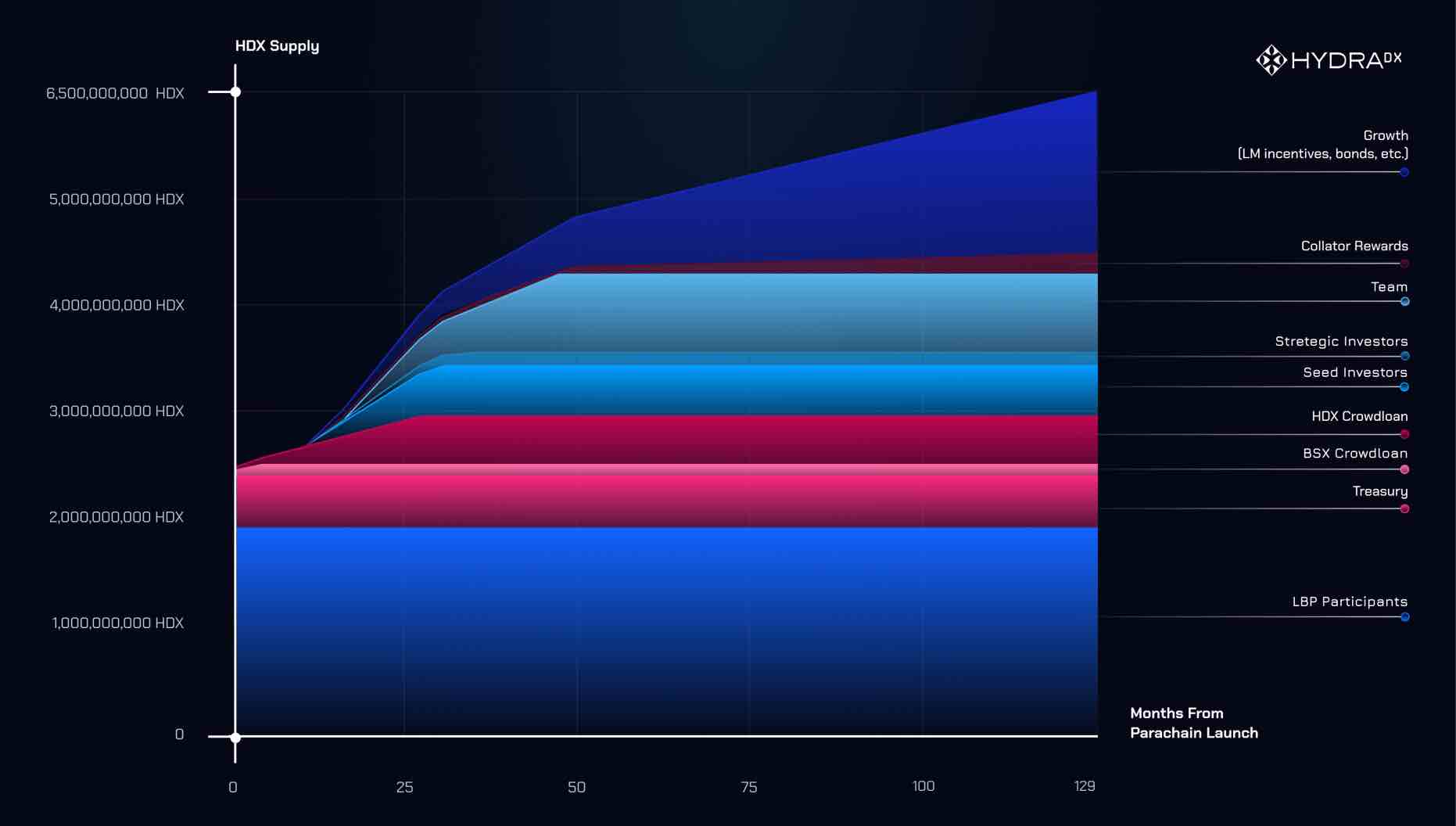

Upon the launch of the Hydration DAO, the defined maximum supply of HDX tokens was 10 billion HDX. However through the governance-approved supply reduction, this defined maximum supply was reduced to 6.5 billion HDX tokens.

The allocation of these tokens is currently as follows:

- LBP Participants - 30.5% (~1.983B)

- Founders and team - 12.5% (810M)

- Investors - 10.6% (690M)

- HDX Crowdloan - 7.6% (~494.6M)

- BSX Crowdloan - 1.9% (~120.7M)

- DAO treasury - 5.5% (~354.5M)

- Collators - 3.9% (~251.5M)

- Growth - 27.6% (~1.796B)

HDX Emission Schedule

As of Sept 2023, ~2.6 billion of HDX tokens are in circulation.

There is currently no concrete emission/release schedule for HDX tokens residing in the Treasury and Growth allocations. Hydration intends to distribute the supply of HDX in the treasury and growth funds to help fund ecosystem development where opportunities may arise. All of these distributions will be discussed transparently to the community beforehand and voted on by the Hydration DAO.

Token distributions range from a variety of developmental purposes and growth initiatives, (eg. HDX bonds, liquidity provider rewards, integrations/partnerships with other projects, etc).